.png?width=2000&height=250&name=cimplx.Case.For.Changee%20(4000%20x%20500%20px).png)

Making the Case for Change

How to build a case for a single payroll solution that aligns with business goals

Introduction

For most organizations, payroll challenges emerge at year-end — when the pressure is on. Problems associated with legacy payroll systems, including reporting, balancing efforts, special file loads, reconciliations, and unique file types can create time-consuming, error-prone bottlenecks. Frustrated by these limitations, forward-looking payroll managers are proposing changes to improve payroll by streamlining processes and modernizing technology. Too often, however, their plans get swept aside and another year goes by without implementing a new solution that could save time, reduce costs, improve compliance, and drive employee engagement.

Every organization wants to deliver perfect checks on every payroll run. But how can you achieve payroll accuracy and solve year-end challenges if you’re still relying on outdated payroll technology? Legacy payroll systems lack a number of advanced features and capabilities that improve payroll efficiency, accuracy, and compliance including:

- Seamless integration with other applications such as HR, time and attendance, and finance

- Automated regulatory updates that make it easy to stay up-to-date with federal, state, and local jurisdiction requirements

- Mobile and self-service tools that engage employees — and reduce the burden on payroll staff

- A real-time view of payroll status at any point in a pay cycle

- On-demand reporting that supports data-driven business decisions

- Automated workflows that drive efficiencies while providing complete control over your entire payroll process

But simply knowing what’s missing in your payroll system will not be enough to convince the decision makers in your organization that it’s time to invest in change. To get the attention of leadership and IT, and persuade them to review and approve your business proposal, you’ll need to answer this question: How will a new payroll system help the organization reach its critical business objectives?

Payroll professionals are turning to modern HR and payroll technology to help them meet growing demands to achieve better business results. By investing in a new solution as an integral part of their business strategy, organizations can better align payroll with key goals and objectives. At the same time, the payroll team benefits from the automated tools and processes they need to manage day-to-day activities and undertake projects that can value and improve bottom-line results.

Making a compelling case for change isn’t easy. Executives have many competing projects to evaluate and finite resources available to implement them. So how can you gain their critical buy-in? Your start by preparing a business case that clearly shows how a modern payroll system will help solve pressing business problems and deliver significant financial benefits to the organization.

In this paper, you’ll learn how to gather the insight, evidence, and support you’ll need to present a persuasive

proposal for change will successfully capture the attention of executive decision makers.

Build a Case for Change: Define the Business Impact

Your payroll business case will need to identify the costs associated with your legacy system and the potential

hard- and soft-cost savings that could be realized by investing in a new payroll solution. The following five key

areas of payroll are commonly used to build the case for change.

1. Payroll errors

According to the 2020 Payroll Trends Survey, 20% of payroll professionals admitted to cutting corners to ensure that payroll was delivered on time.1 Paycheck errors can be introduced from supporting data sources that feed into the payroll system, such as time entry, deductions and/or benefits changes, unaccounted overtime, wage garnishments, and more. But regardless of where the error originates, the result is an incorrect paycheck. When payroll errors occur, companies not only incur the immediate cost of fixing the mistake, but they also risk longer-term erosion of engagement and productivity if employees lose confidence in the accuracy of their pay.

Payroll errors made in the company’s favor put your organization at risk of potential penalties and must be fixed promptly, resulting in costly rework. Organizations typically make a similar percentage of payroll errors in the employee’s favor, which may go unreported and add up to significant payroll inflation over time. Clearly articulating how a modern payroll system can reduce this error rate — and save the company money — will help you gain executive buy-in, especially from the CFO.

Research shows that businesses can reduce their payroll error rate by implementing modern payroll technology, — even if their previous system was partially or fully automated.2 Another study found that companies that close out payroll the fastest also had the lowest error rates3 — another advantage that modern payroll technology brings to the table.

2. Payroll productivity

Many organizations face a “do more with less” mandate, which extends to their staffing. Tight budgets are getting even tighter and staffing and resources are being impacted, which can affect the retention of payroll personnel. The expectation is that payroll teams can still produce the same quality (or better) and the same volume of work with fewer resources. Under these circumstances, payroll is being pushed to streamline processes, eliminate manual systems, and reduce data entry — changes needed to accomplish routine tasks and free payroll professionals to contribute to company goals and objectives.

To evaluate payroll productivity for your business case, you should look at how a new payroll solution can help

you reduce both hard costs (overtime) and soft costs (freeing staff for new projects and strategic initiatives).

The first step is to calculate the time it takes from obtaining gross data, including wrangling timesheets,

to closing out the payroll period and generating reports. The American Payroll Association’s 2019 Payroll

Trendline Survey established the following benchmarks for the time it takes to close out payroll.4

| Time to close out payroll | Percentage of Organizations |

| 1 Day | 28% |

| 1-2 Days | 50% |

| 3+ Days | 22% |

If your organization is taking longer to complete these steps, inefficient processes and outdated technology may be to blame. As a result, you’re likely experiencing increased costs, reduced productivity, and lost opportunities to tackle other payroll projects.

Modern HR and payroll technology will reduce the total processing time required, especially if the automated solution combines timekeeping and payroll in an integrated platform. More than 18% of payroll processing time is spent on data entry tasks, which also rank highest in error-prone activities at 35%.5 Reducing processing time delivers hard-cost savings through reduced overtime. Organizations can also achieve valuable soft-cost savings that allow staff to focus less on administrative tasks and more on the strategic aspects of payroll. The time saved can be reallocated to other payroll projects and company initiatives, such as direct deposit campaigns, pay card programs, on-demand pay, training and development, and establishing key performance indicators (KPIs) for payroll.

3. Self service

Employee self-service capabilities increase payroll efficiency and productivity while contributing to a highly engaged workforce. To build the business case for self-service, determine how much time payroll staff spends manually entering data, reviewing paycheck data, confirming banking deposit, and responding to other employee inquires.

It may be helpful to compare your organization against the following industry benchmarks.

- The average time to enter a new hire into the system is 2.19 days6

- 1 in every 4 organizations responds to over 1,000 payroll inquiries annually7

- The average resolution time for a payroll inquiry is 1.54 days8

- The most common inquiry is related to pay slip questions, at 25%, followed closely by missing pay,

at 22%9

Giving employees self-service tools, such as the ability to submit tax and direct deposit information and view current and past pay statements right from their desktop or mobile device, reduces time-consuming administrative work for the payroll staff. Even if employees occasionally need assistance with self-service functions or make a mistake, your payroll department will still realize significant productivity gains. With self-service capabilities, HR and payroll administrators gain back valuable time to focus on other tasks while employees are empowered to access and update information on their own — anytime, anywhere — for a more connected work experience.

Mobile and self-service tools empower employees to find and update

payroll-related information on their own so HR and payroll administrators

can focus on other value-added tasks.

4. Total cost of current payroll processes

Many organizations may not realize the costs associated with their current system could add up to more than the cost of a proposed new payroll solution. And considering the likely advantages of better systems and more advanced technology, including greater speed, accuracy, more sophisticated reporting and analysis, and improved employee engagement and morale, the argument that such improvements more than pay for themselves appears to have some merit.10

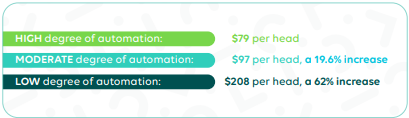

In order to increase the efficiency of your payroll process, you must understand the total cost of your current process. Be sure to factor in all costs — from software and hardware to IT support, in-house printers, education and training, and more. The industry average cost per head for payroll is $104 for a weekly payroll and $96 for a biweekly process. The total payroll cost per head varies, depending on the level of automation an organization has in place, as shown below.11

Remember to account for any customizations that have been made to the legacy system as these can add

to your ongoing maintenance costs and hinder your ability to receive critical, timely updates. Without these

updates, your pay calculations could be inaccurate and might require additional time and effort to record,

pay and post, or possibly correct.

Many organizations may not realize the costs associated with their

current system could add up to more than the cost of a proposed

new payroll solution.

5. Compliance Risk

Payroll professionals face an enormously challenging regulatory environment that cannot be easily managed with a manual or partially automated solution. Many companies simply do not have the expertise in every legal and tax change that payroll teams must address in order to process payroll appropriately. Payroll leaders need to consider how new rules affect payroll and their organization — and how to plan system updates to ensure

ongoing compliance.

Constantly changing legislation and regulations expose payroll to the risk of noncompliance, which can lead to costly fines, damage to credit ratings, and, in extreme cases, imprisonment. U.S. companies receive an average of 4.8 inquiries from regulatory agencies each year, which means organizations must always be prepared to demonstrate compliance. A Mercer survey found that companies pay $4.36 in penalties per employee per year.13 Those penalties add up quickly: a 1,000-employee company could be hit with $21,800 in penalties (five audits per year x 1,000 employees x $4.36 penalty per employee).

Some compliance-related costs are harder to define, but they can still be harmful to your organization’s bottom line. For example, when employees don’t receive accurate, timely compensation, they may face higher levels of financial insecurity. Inaccurate pay, along with missed or incorrect benefits, deductions, or tax withholdings, can lead to lower levels of employee engagement, productivity, and retention — all of which can adversely

affect customer service and overall business performance.

Legacy systems only compound compliance challenges. As systems age, it becomes more difficult to automatically enforce rules that reflect the latest wage and hour laws and other regulatory requirements. More customizations are required to keep up with regulatory changes and updates, and with each new customization, your organization faces an increased risk of noncompliance.

Building the Case for Change: Establishing the Business Need

Now that you’ve identified the cost savings, productivity gains, and employee engagement benefits that can be realized from a modern payroll system, it’s time to create a compelling argument to present to leadership. Articulating the business need and potential value in terms that will resonate with leadership — from improving payroll processing speed and accuracy to minimizing compliance risk — is key to gaining buy-in and funding to move forward. Most important, the business case must answer the question: Why should the organization spend its time and money investigating and implementing the proposed solution?

You’ll make a more convincing argument if you tie your proposed solution to critical payroll-related business goals, such as streamlining processes, reducing costs, increasing productivity, and improving compliance and controls. To define the business need, provide supporting business drivers, and demonstrate the value of the proposed solution, your business case should include the following:

- Business challenge: What are the greatest challenges your organization faces today when it comes

to processing payroll? - Strategy: Does your existing payroll system support the company’s business strategy and goals?

What opportunities could the organization take advantage of by going forward with the project?

What risks or liabilities could be reduced or mitigated? - Change: Why is now the time to make the change?

As you establish the business need, you must provide a detailed account of the current system and its shortcomings as well as a complete view of what will be gained with a new, more modern payroll system. Use the following list of business drivers to illustrate where key areas impact the business and how new technology can be used to make improvements or mitigate risk.

|

Increase Compliance and Control: Changes and updates from federal, state, local, and regulatory agencies should be automatically updated to the payroll system in a timely manner. In addition, reporting capabilities and a full audit trail should be integral to the payroll application, providing on-demand access to audit compliance data when needed. |

|

Reduce Payroll Errors: Workflows and checklists within the payroll solution help the payroll team stay in sync, reduce errors, and cut down on administrative time involved in using manual and separate worksheets to track the payroll process. |

|

Eliminate Redundant Manual Data Entry: Mobile and self-service tools empower employees to enter data such as W-4 and direct deposit information, address changes, and state and local tax changes on their own — saving the payroll team significant time and effort. |

|

Reduce Costs Through Mobile and Self-Service: A unified payroll solution enables employees to view their payroll-related data easily, reducing the time payroll professionals spend responding to employee inquiries and allowing them to focus on strategic payroll projects. |

|

Improve Business Visibility Through Payroll Reporting: Multilevel security and access for different groups means that managers, operations, and business leaders can schedule and view their own reports with varying levels of detail and make informed, data-driven decisions. |

|

Increase Employee Engagement: Modern payroll technology can increase engagement for all employees — not just the payroll team. Confidence in timely, accurate paychecks relieves financial stress and uncertainty, resulting in increased employee productivity and better morale. |

|

Reduce Processing Costs: If you’re using a payroll service bureau, you could incur fees for check printing/direct deposit advice printing (and distribution), reopening a closed quarter, the 941/3-X process, the W-2c process, and more. In addition, most service bureaus have hidden costs of unrealized float and lost cash-flow flexibility on quarterly tax withholdings. |

Building a Business Case for Change: Identify Stakeholders and Gain Support

Organizing a team, identifying key stakeholders, and gaining support from connected departments are necessary steps for any successful project. Once you’ve identified the business drivers and defined the purpose for the change, you need to convey this information to others to garner their input and support. It’s important to determine who the key stakeholders will be and what their concerns and needs are in order to build the most persuasive case for change.

There are two key roles to consider in building out the project and business case. Identifying who occupies these roles and gaining their buy-in prior to submitting the business case will go a long way toward making your project a success.

- Sponsor: A business case usually requires an executive sponsor. The sponsor is typically an executive

within the functional organization that is driving the case for change. The sponsor often helps articulate

and quantify the value the organization will receive from the investment. For payroll business cases, the

CFO or CHRO is often the sponsor. - Business Owner: The business owner bears the highest accountability for demonstrating and selling the

case as well as providing the resources and guidance needed to develop it. For payroll business cases, HR,

finance, or payroll could be the business owner.

Payroll processes affect every person in the organization and changing the way things are done can be unnerving for some people. It is important to get buy-in from different roles and departments and recognize their concerns, including what works and what doesn’t in the legacy payroll system, and what to watch for as you move to a new solution.

Finalizing the Case for Payroll Change

As you complete your business case, make sure that you’ve linked each new payroll technology improvement to a specific business benefit for the organization. The benefit might not always be hard-dollar savings, but every case should show how a modern payroll solution will positively impact the company and advance your business goals. Quantifying the benefits in terms of staff resources and allocation, cost reduction, productivity gains, and higher employee engagement not only shows how your business case supports efficient end-to-end payroll processing, but also how it helps the company improve profitability.

Each case will have its own unique set of business drivers and solutions. However, it is critical that every case answer the following question as to why investing in new technology benefits the business: What value will a new payroll solution provide that our existing system does not?

The following chart shows how payroll technology improvements can be aligned with a benefit to demonstrate value.

| Technology Area | Improvement Enabled | Concerns |

| Streamlined, automated processes |

Continually updates payroll in real time to eliminate the need for pre-processing and supports use of checklists and workflows within the payroll technology | Increases productivity, provides consistency, and is completely auditable |

| Mobile/self-service (Customer service) |

Empowers employees to access their own payroll-related data, reducing the time payroll spends on employee inquiries |

Boosts efficiencies and reduces costs while improving employee satisfaction and engagement |

| Mobile/self-service (Reduced manual processes) |

Promotes employee entry of personal payroll data such as W-4, address changes, and direct deposit | Improves productivity, drives efficiencies, and reduces manual data entry for payroll staff — saving time and effort |

| Powerful reporting | Provides secure access to business partners within the company and supports better management of requests and output | Increases efficiency, improves accuracy, and helps business partners make informed and timely decisions |

| Synchronized compliance updates |

Automates compliance updates, reducing the need for customization and enabling native audit trail reporting | Minimizes compliance risk, potential wage and hour lawsuits, penalties, and fines while freeing payroll to focus on providing strategic insight to business leaders |

Conclusion

Your business case is the starting point for any successful payroll software project. The more accurate and complete your business case, the easier it will be for key decision makers to determine the value new payroll technology will provide and the impact the project will have on the business. Modern HR solutions, such as those provided by UKG, are built on a single platform that leverages a common source of data for payroll and timekeeping to streamline processes, increase efficiency, and simplify compliance and reporting. With new technology in pace to automate end-to-end payroll processing, your organization will be better positioned to reduce costs, increase productivity, and improve the employee experience — all while accelerating payroll’s shift from a tactical, back-office function to a critical, strategic business role.

Get Started Today

Ready to start developing your payroll business case? Need assistance? Give us a call at +1 803-262-2377 or visit us at cimplx.com to find out how cimplx can help you identify the ROI potential for your payroll project and make a compelling case for change.